Your small business entity, sometimes called legal structure, may be the most important participant on your staff. It is foundational to carefully select the structure that’s most effective for your small business financing, and exploit the benefits of that company legal arrangement.

The issues that could affect your business entity choice – LLC, DBA or INC:

1 The total volume of your expenses and income

2 Tax Strategies not to pay excessively

3 Liabilities that could result from your goods, services or construction locations.

4 Do you have partners or investors in Your Company

5 What State is your residence located and your company location headquarters

6 Business plans for future and your marketing strategies

7 The regulatory expenses and asks of establishing legal structures

To select the right one for your business investigate these four top options.

1. Kabbage and Crowdsourcing

The ascent of online financing lenders, as Kabbage, OnDeck, or crowdfunding destinations, suggests that business visionaries have more options for financing than any other time in recent memory. These might be good alternatives for sole proprietorships DBA (doing buisiness as).

Kabbage and OnDeck are both short term business loan lenders. The loan terms are from one year for Kabbage and three months up to three years maximum loan term for OnDeck business loans. These loans are easier than getting a bank loan approval.

Crowdfunding is another strategy. Destinations for site crowdfunding, Kickstarter, RocketHub, peerbacker, and Indiegogo make it easy to get out a word of your business since the funding is raised by you. It is the modern way to hit up loved ones to help get your business launched done anew online with crowds.

Likewise, as with SBA loans, crowdfunding and online loaning can be appropriate alternatives for many business structures. They are also especially helpful approaches to rustle up some money for a company that’s as of today settled, however, that has faced budgetary hardship, (by way of instance, a customer-facing facade fire, a burglary, or other startling events). Without the money, the company won’t have the capacity, but it’s going to be able to channel gains into paying off the obligation, once it has recovered.

2. Microloans. Grants, SBA Loans

The U.S. SBA provides a range of loans to organizations that match the government’s meaning of “small.” The most frequently recognized advance application, the 7(a) advance application, stipulates certain other criteria: the business should likewise be for-benefit, work in America, and have sensible contributed worth; what is more, the owner must have formally utilized individual money associated assets before searching for SBA help.

There’s yet another alternative called SBA’s microloan program for qualified borrowers. Get up to $ 50,000, notwithstanding how the microloan is closer to $ 13,000 on average.

While the Small Business Administration that’s small doesn’t provide concedes, some nearby and state jobs, and additionally non-benefit institutions, do provide awards to entrepreneurs. Normally these stipends require either a coordinating commitment or a simultaneous progress; they aren’t really “free money.”

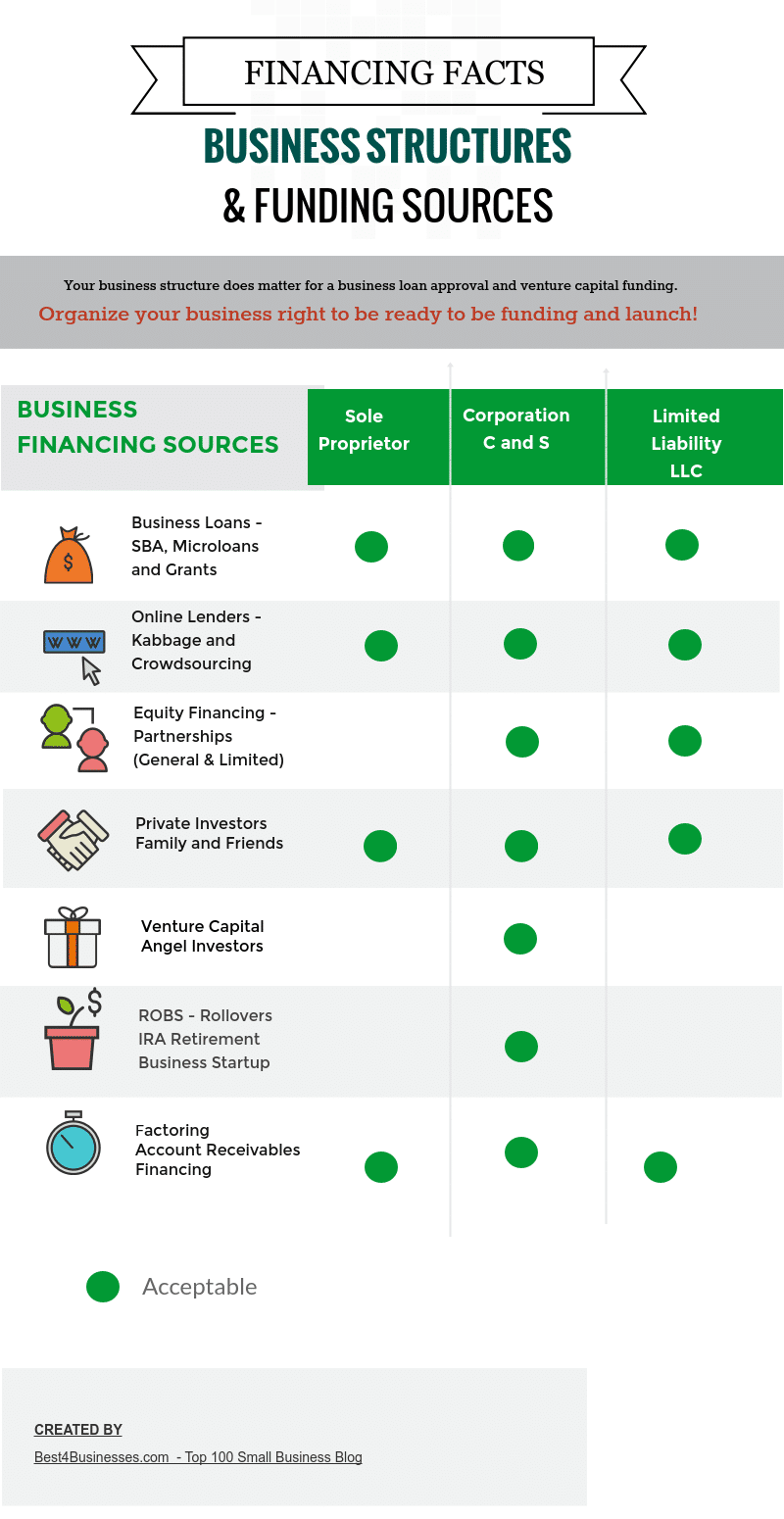

These funding options are fitting for a wide assortment of business structures. It will not make a difference if your organization is going to be a PLLC a sole proprietorship or LLC, or an enterprise.

3. Venture Capital and Angel Investors

A few sorts of funding require that your company be utilized, as either an S or a C corp.. These are financial pros and speculators that are financing.

Funding (VC) and investor speculator financing options are also available to new businesses. These specialists invest funds into your business in return for equity ownership.

VC is great because you don’t have to pay it back, because you already “paid back” the venture capitalists with stock shares of your company.

It can be tough to secure this kind of financing. Shows such as Shark Tank might provide the idea that you can get without much of a stretch capture the attention of VC firm or an investor to business people. They do not incline to perform as such until the stage once the entrepreneur himself has contributed her funding while those investor experts offer their responsibilities at the seed arrange. By then, that the danger merits may be felt by the specialist.

Investment companies tend to invest capital afterwards, once seed funding was set up; they do not have a propensity to put funds into new businesses, either, but rather in organizations which, while still too small to bring backing up in broad daylight markets, are all things considered prepared to upset their business and supply productive payouts.

Picking your legal business structure and receiving business financing are two enormous elements of starting a business. You’ll be well on your way to a new pursuit when you get these ducks!

4. Equity Financing

This sort of private business funding, which involves pitching supplies of their company to raise capital, conveys different pros and cons.

With equity subsidizing, there is no stress on individual credit problems, and no obligation to reimburse. Anyway, by setting up a company (either limited or general) — for which worth subsidizing is the most widely recognized and prevalent type of financing, you’ll receive impalpable benefits, also. Accomplices that are experts in your business, or more experienced as businessmen, can fill in as tutors and advisers, whatever the possibility that they’re considered limited or noiseless accomplices (suggesting that they bear no obligation).

A few small business people might have to take some real time to consider before plunging into an institution — especially an overall organization, where they will share responsibilities and fundamental leadership. Surrendering control over the business of one may be troublesome pill if the accomplices contrast style or vision for your 34, and strains can emerge.

When you decide which legal business structure is right for you, LLC, INC or DBA – Use this referral code for Legalzoom discount of 10%

Moreover, a equity subsidizing or business plan of action implies that if the benefits start to come in, you’re going to be sharing the prizes and additionally the obligations. Entrepreneurs are okay with the profit sharing part of equity funding. They know that without business insight and the venture they won’t have left a benefit — or quite a little one.

For apparent reasons, your organization can not be a sole proprietorship and an institution. Be that as it might, as a business, it’s surely attainable desired, to pull in specialists.

About the Author:

Marsha Kelly sold her first business for more than a million dollars. She has shared hard-won experiences as a successful serial entrepreneur on her blog Best 4 Businesses http://best4businesses.com. Marsha also regularly shares business tips, ideas, and suggestions as well as product reviews for business readers. As a serial entrepreneur who has done “time” in corporate America, Marsha has learned what products and services really work well in business today. You can learn from her experiences from shopping the internet for tools, supplies, and information to build your businesses and improve lives financially.